If you have a mortgage loan with an escrow account, you know that it helps take the guesswork out of budgeting for property taxes and insurance. Each month, a portion of your payment is set aside in your escrow account so when those bills come due, your lender can pay them on your behalf.

But because those tax and insurance costs can change from year to year, your escrow payment may also change, especially after your annual escrow analysis.

Why Escrow Payments Change

Each year, your lender reviews your escrow account to ensure the right amount is being collected to cover your property taxes and insurance premiums.

- If costs increase, your escrow payment may go up.

- If costs decrease, your payment may go down.

This adjustment is designed to keep your account balanced and ensure there are enough funds to make payments when they’re due.

Most Constitution Bank customers will notice any change reflected in their January mortgage payment following the escrow analysis.

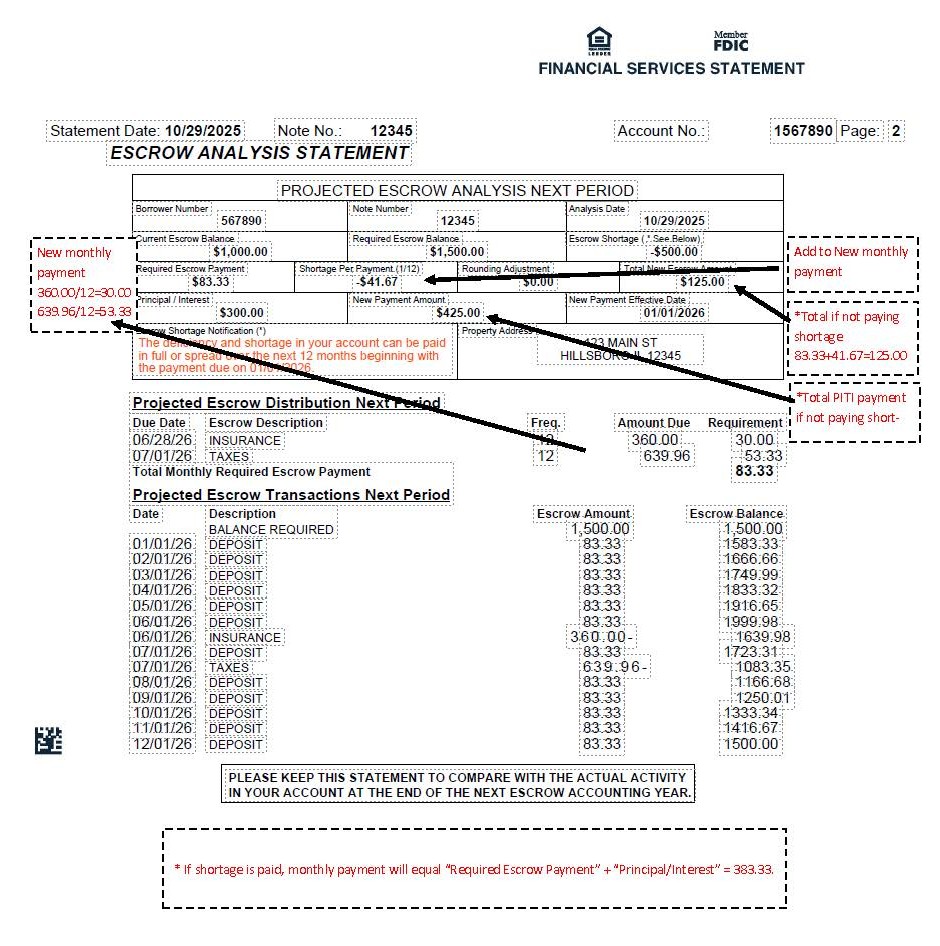

Below is a sample Escrow Analysis Statement:

What Is an Escrow Shortage?

An escrow shortage happens when there isn’t enough money in your escrow account to cover the full cost of your property taxes and/or insurance premiums. This often occurs when:

- Your property taxes increase.

- Your insurance premiums rise.

- A new policy or taxing authority is added during the year.

If a shortage occurs, you have options:

- Pay the shortage in full: This can prevent your monthly payment from increasing as much.

- Spread the shortage over 12 months: Your lender will divide the shortage across the next year’s payments, slightly increasing your monthly escrow amount.

Can Escrow Be Added Later?

Yes! Even if your mortgage didn’t originally include escrow, you can often add an escrow account after closing. This can make managing taxes and insurance easier, giving you peace of mind knowing those expenses are automatically taken care of.

Keeping You Informed

When your escrow analysis is complete, you’ll receive a mailed paper statement detailing your current balance, projected payments, and any changes to your monthly amount. If you have questions or want to review your options, our lending team is always here to help explain your statement and ensure you’re comfortable with your next steps.

At Constitution Bank, we believe in helping you stay confident and informed throughout your homeownership journey because we’re Here for You. Here for Good.